Research Coverage

Private Credit Research Coverage

Direct Lending

U.S. Direct Lending

- Senior

- Opportunistic

- LMM (sponsored)

- LMM (non-sponsored)

- Private BDCs

- Industry Focused

- Revolvers

European Direct Lending

- Senior

- Opportunistic

- LMM

- Country-Specific Funds

Emerging Markets Lending

- Asian

- African

- CEE/Middle East

- Latin American

- Pan-EM

Global Direct Lending

Distressed Debt & Special Situations

Corporate Distressed

- Stress / Distressed Trading

- Influence / Control

- Diversified Distressed

Opportunistic Structured Credit

- 3rd Party CLO Equity

- Captive CLO Equity

- CLO Debt

- CLO Multi

- Consumer ABS

- CMBS/CRE

- Esoteric ABS

- European Structured Credit

- RMBS

- Structured Credit Multi-Sector

Real Estate Distressed

NPLs

Capital Solutions

PC Special Situations

PC Secondaries

Specialty Finance

Consumer & SME Lending

- Marketplace Finance

- Lender/Platform Finance

Rediscount Lending

Factoring & Receivables

Regulatory Capital Relief

Music/Film/Media Royalties

Oil & Gas Minerals Royalties

Metals Royalties

Healthcare Lending & Royalties

- Healthcare Lending

- Healthcare Royalties

Venture Lending

Technology Lending

Financial Services Credit

Insurance Linked Credit

- Diversified

- Life Insurance

- Non-Life

Litigation Finance

- Litigation Finance

- Merger Appraisal Rights

PE Portfolio Finance

Stretch ABL

Diversified Specialty Finance

Real Estate Credit

U.S. CRE Core Lending

U.S. CRE Transitional Lending

- Large Loan

- Middle Market

- Small Balance

- Opportunistic

U.S. CRE Bridge Lending

- Large Loan

- Middle Market

- Small Balance

European CRE Lending

- Bridge

- Transitional

- Core

Emerging Markets CRE Lending

CRE Structured Credit

- Agency CRE B-Piece

- Non-Agency CRE B-Piece

Residential Mortgages

- Residential NPLs

- Single Family Rental

- Mortgage Servicing Rights

- Residential Origination

Real Assets Credit

Infrastructure Lending

- Senior Focus

- Sub-IG Focus

- Mezz Focus

Energy Credit

- Energy Lending

- Energy Mezzanine Lending

- Opportunistic

Trade Finance

Metals & Mining Finance

Agricultural Credit

Transportation

- Aviation Lending

- Maritime Lending

- Road & Rail Lending

- Transportation Lending (Multi)

Mezzanine

U.S. Mezzanine

- Upper Middle Market

- Middle Market

- Lower Middle Market

European Mezzanine

Structured Equity

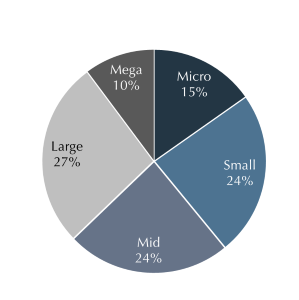

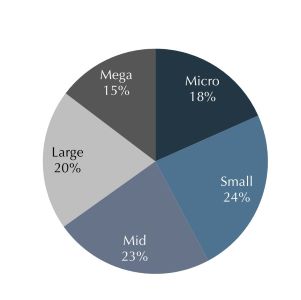

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

Private Equity Research Coverage

Buyouts

Geographic Focus

- Global Buyout

- North American Buyouts

- European Buyouts

- Asian Buyouts

- Emerging Markets Buyouts

Deal Strategies

- Traditional Buyout

- Buy & Build

- Carve Outs

- Recapitalizations

- Expansion

- Take Privates

- Long Duration

- PIPE

- Turnarounds

Market Cap Focus

- Lower Middle Market

- Middle Market

- Upper Middle Market

- Large

- Mega

Industry Scope

- Industry Specialist

- Generalist

Venture Capital

Stage Focus

- Early Stage VC

- Late Stage VC

- Multi Stage VC

Industry Scope

- Industry Specialist

- Generalist

Geographic Focus

- North America

- Asia & Pacific

- Europe

- Global/Other

Growth Equity

Geographic Focus

- Global Growth Equity

- North American Growth Equity

- European Growth Equity

- Asia Growth Equity

- Emerging Mkts Growth Equity

Mezzanine

Strategies

- US Mezzanine

- European Mezzanine

- Structured Equity

Distressed for Control & Special Situations

Strategies

- PE Special Situations

- Distressed for Control

- Corporate Distressed

- Real Estate Distressed

- Capital Solutions

GP Stakes

Strategies

- Portfolio

- Single GP

Private Equity Secondaries Funds

Strategies

- PE Secondaries Fund

- PE Secondary Port. Purchase

Geographic Focus

- North America

- Asia & Pacific

- Europe

- Global/Other

- < 1 billion

- 1-5 billion

- 5-10 billion

- 10-15 billion

- >15 billion

Hedge Fund Research Coverage

Long / Short Equity

Opportunistic

Fundamental Growth

Fundamental Value

Low Net

Specialist

- Consumer

- Financials

- Healthcare

- Natural Resources

- Real Estate

- TMT

Event Driven

Event and Merger

- Debt & Equity

- Event & Merger

- Hedged

Event Credit

- Event Credit

- Financial Credit

- Distressed & Restructuring

- High Yield & Stressed

Activist

Relative Value

Long/Short Credit

- Convertible Arbitrage

- Credit Trading

- Multi-Asset Class RV

Structured Credit

- Commercial Real Estate

- Corporate Structured Credit

- Diversified Structured Credit

- Residential Structured Credit

Fixed Income Arbitrage

- G10 Fixed Income Arbitrage

- Mortgage Derivative RV

Insurance Linked

- Diversified Insurance

- Life Insurance Linked

- Non-Life Insurance Linked

Quantitative Strategies

- Diversified Quant Strategies

- Fundamental Market Neutral

- Statistical Arbitrage

Volatility

Tactical Trading

CTA

- Diversified

- Short Term

- Trend Following

Active Commodities

- Commodities L/S

- Long-Biased Commodities

- Relative Value Commodities

Global Macro

- Asia Macro

- G10 Macro

- Emerging Markets Macro

- Systematic Macro

Risk Mitigators

- Short-Biased Credit

- Short-Biased Equity

- Tail Risk

Multi-Strategy

Relative Value Multi-Strategy

- Non-PT RV Multi-Strategy

- Pass Through RV Multi Strategy

Multi Risk Premia

- Multi Risk Premia

Asia Multi-Strategy

- Asia Multi-Strategy

Directional Multi-Strategy

- Directional Multi-Strategy

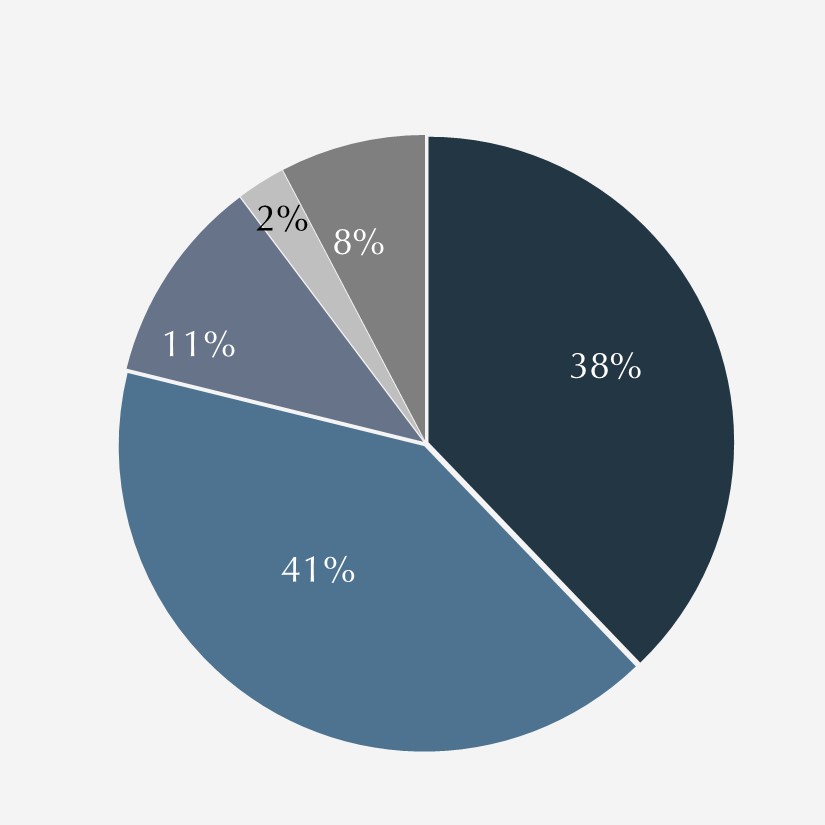

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

Infrastructure & Natural Resources Research Coverage

Infrastructure

Diversified Infrastructure

- Diversified

- Energy

- Transportation

- Communications

- Social

- Renewables

- Logistics

- Water

Oil & Gas Midstream

- Gathering and Processing

- Storage

- Rail, Trucking, Barges

- LNG

- Long-haul pipelines

- Diversified

Power

- Diversified

- Conventional

- Renewable

- District Heating

- Transmission & Distribution

Renewables

- Solar

- Wind

- Battery Storage

- Hydro

- Biogas

- Clean Technology

- Diversified

- Utility Scale

- C&I

- Residential

- Offshore Wind

Transportation

- Air

- Marine

- Parking

- Roads

- Rail

- Diversified

Communications

- Data Centers

- Towers

- Fiber

- Small Cells

- Spectrum

- Diversified

Social

- Government

- Education

- Healthcare

- Economic

- Cultural & Recreational

- Diversified

Natural Resources

Agriculture

- Agribusiness

- Farmland

- Indoor Farming

- Permanent Crops

- Ranchland

- Diversified

Water

- Desalination

- Waste Water Treatment

- Water Rights

- Diversified

Mining & Minerals

- Base Metals

- Bulk Commodities

- Precious Metals

- Rare Earths

- Diversified

Timber

- Natural Forests

- Timber Plantations

- Diversified

Oil & Gas

- Upstream

- Downstream

- Services

- Diversified Oil & Gas

Real Assets Credit

Infrastructure Lending

- Senior Focus

- Sub-IG Focus

- Mezz Focus

Energy Credit

- Energy Lending

- Energy Mezzanine Lending

- Opportunistic

Trade Finance

Metals & Mining Finance

Agricultural Credit

Transportation Credit

- Aviation Lending

- Maritime Lending

- Road & Rail Lending

- Transportation Lending (Multi)

Real Assets Multi-Manager

RA Secondaries Funds

Specialty Finance

Metals Royalties

Oil and Gas Minerals & Royalties

Healthcare Royalties

- Healthcare Lending

- Healthcare Royalties

Music/Film/Media Royalties

Tactical Trading

Active Commodities

- Commodities L/S

- Long-Biased Commodities

- Relative Value Commodities

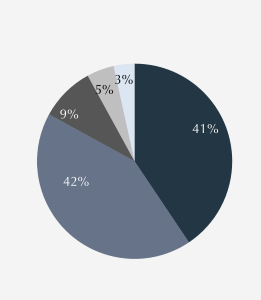

- < 1 billion

- 1-5 billion

- 5-10 billion

- 10-15 billion

- >15 billion

Real Estate Research Coverage

Real Estate Private Equity

Primary Property Type

- Data Centers

- Diversified

- For-Sale Residential

- Hospitality

- Industrial

- Land

- Life Sciences/Lab

- Medical Office

- Multifamily

- NNN

- Office

- Other

- Parking

- Retail

- Self Storage

- Senior Living

- Single-Family Rental

- Student Housing

Risk Profile

- Core

- Core+

- Value-Added

- Opportunistic

RE Strategy Details

- Property-Type Focused

- Develop to Hold

- Develop to Sell

- Property Technology (PropTech)

- Operating Companies

- GP Fund

Manager Profile

- Direct Operator

- Allocator

- Hybrid

Geographic Focus

- Global

- North America

- Europe

- Asia-Pacific

- Latin America

US Regional Focus

- National

- East

- Midwest

- South

- West

Real Estate Public Markets

Public Markets

- Active

- Passive / Index

Geographies

- Global

- North America

- Europe

- Asia-Pacific

- Latin America

Real Estate Credit

U.S. CRE Core Lending

U.S. CRE Transitional Lending

- Large Loan

- Middle Market

- Small Balance

- Opportunistic

U.S. CRE Bridge Lending

- Large Loan

- Middle Market

- Small Balance

European CRE Lending

- Bridge

- Transitional

- Core

Emerging Markets CRE Lending

Residential Mortgages

- Residential NPLs

- Single Family Rental

- Mortgage Servicing Rights

- Residential Origination

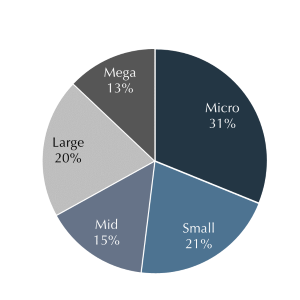

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

As of June 30, 2024. Coverage by geography and fund size is representative of the universe of investment programs (where a program is defined as a group of funds managed by the same manager which pursue a similar investment strategy, leverage, and/or investor pooling) on which Aksia has conducted due diligence (IDD, ODD, or Insight Report).

Each investment program is uniquely counted in its primary asset class (e.g., real estate credit funds are included in the private credit asset class coverage figures only).